The Government plans to complete a formal bid document for outsourcing management of Nassau’s cruise port within the next two to three weeks, a Cabinet minister has revealed.

The Government plans to complete a formal bid document for outsourcing management of Nassau’s cruise port within the next two to three weeks, a Cabinet minister has revealed.

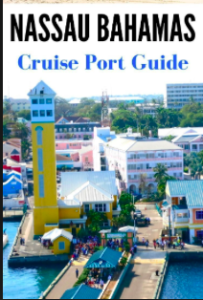

Dionisio D’Aguilar, minister of tourism and aviation, confirmed to Tribune Business that a formal Request for Proposal (RFP) will be issued to transform Prince George Wharf into the cruise tourism equivalent of Lynden Pindling International Airport (LPIA).

Given that the downtown Nassau dock acts as “the gateway for 3.6 million” cruise visitors per year, Mr D’Aguilar said it needed an overhaul comparable to LPIA under the Nassau Airport Development Company’s (NAD) management, which had “not cost the taxpayer a dollar”.

He added that private investors and capital were essential to finance improvements to Nassau’s cruise product, with the Government viewing upgrades to Prince George Wharf as potentially kick-starting development throughout the downtown and Bay Street areas.

Mr D’Aguilar declined to identify the two consortia asked to submit bids, but one of those groups is almost certainly UK-based Global Port Holdings and its Bahamian partner, BISX-listed Arawak Port Development Company (APD), together with investment advisory firm, CFAL (formerly Colina Financial Advisors).

APD made no secret of their interest in its 2017 annual report, revealing that the partners planned to add “additional berths and facilities” to the Bahamas’ busiest cruise port if the Minnis administration gave their project the go-ahead.

Global Port Holdings generated $115m in revenue in 2016, and APD’s annual report said: “In response to the Government’s interest in improving the operational and financial performance of Prince George Wharf, APD is exploring the possibility of a joint venture with Global Port Holdings, the largest global cruise port operator in business today.

“This company is considered the world’s largest cruise port operator with a portfolio that includes 14 ports in eight countries, serving cruise liners, ferries, yachts and mega yachts,” APD said of Global Port Holdings. “Additionally, Global Port Holdings has connections with all the major cruise lines – Carnival, Royal Caribbean, MSC Cruises and so on.”

APD is 40 percent owned by the Government, with the shipping companies and related businesses that relocated from Bay Street in 2011 holding a further 40 percent. The remaining 20 percent is held by public investors.

Data published by the Central Bank shows that despite a 23.7 per cent increase in cruise passenger arrivals from 2010 to 2016, rising from 3.8 million to 4.7 million per annum, total spending has remained stubbornly at $300 million. This is because per passenger spending yields have fallen from $78 to $64 over the same period, a drop of 18 per cent.

Mr D’Aguilar said there were “many other reasons” to improve Nassau’s cruise product, including the 90 new, larger cruise vessels currently under construction, and which all Caribbean ports are now competing to attract.

Source: Tribune242