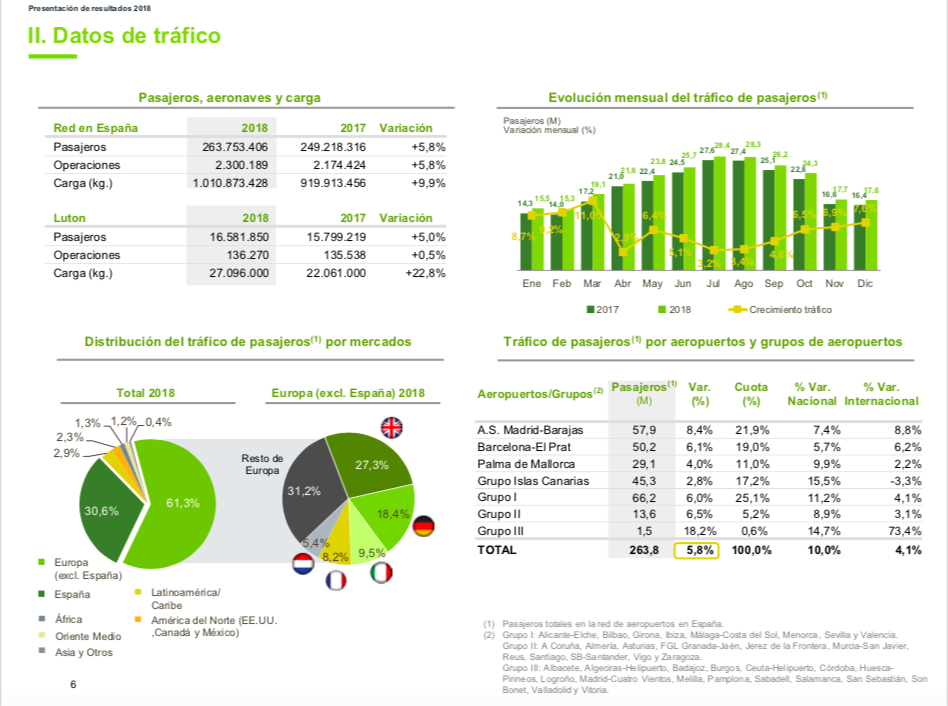

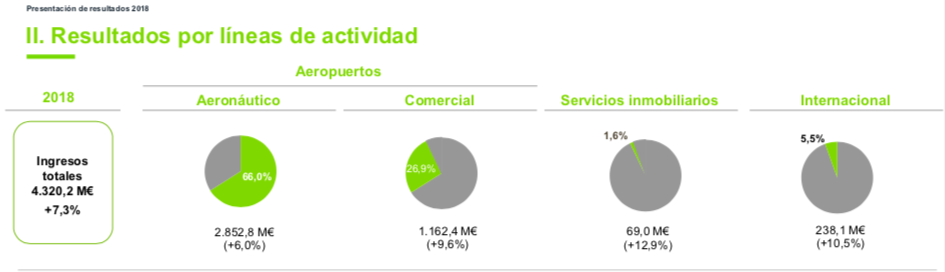

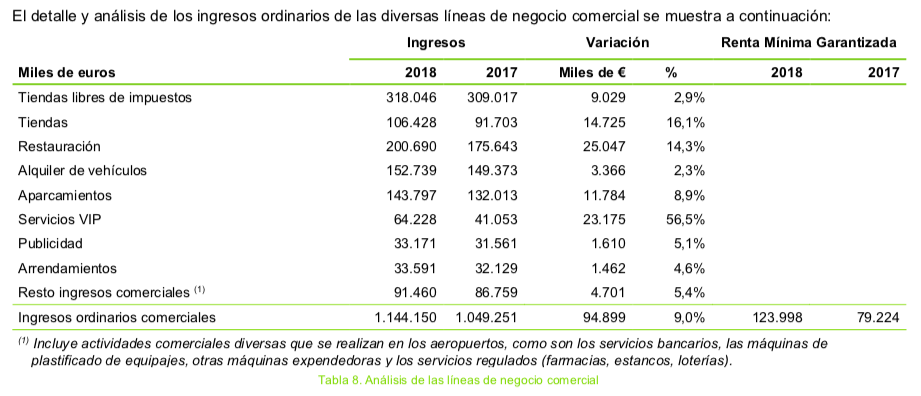

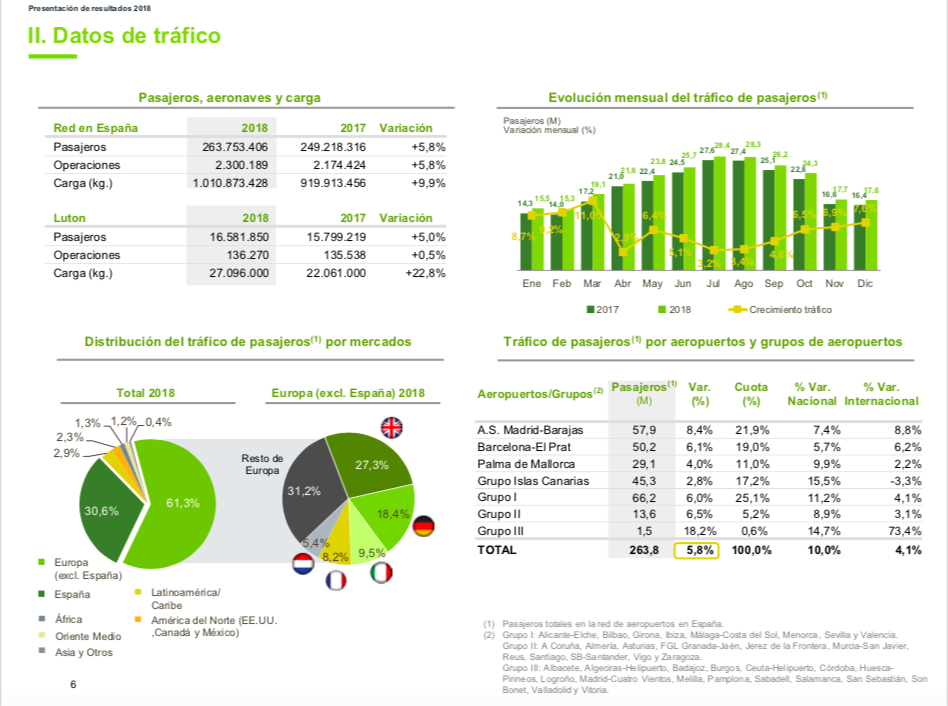

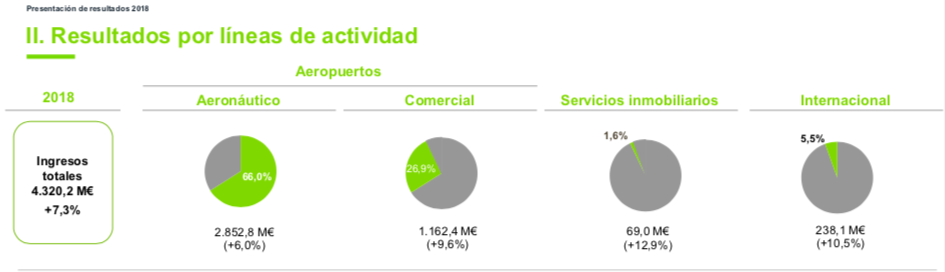

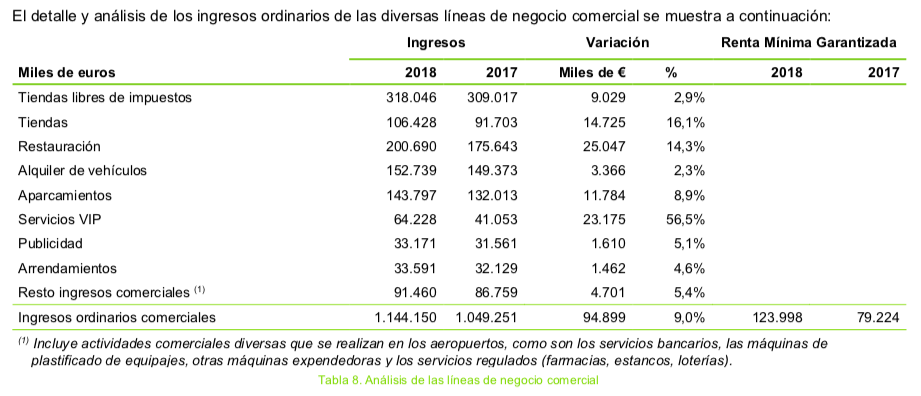

AENA, operador español de aeropuertos, ha presentado el Informa Anual del 2018.

Estas son las principales magnitudes:

AENA, operador español de aeropuertos, ha presentado el Informa Anual del 2018.

Estas son las principales magnitudes:

Ebixcash on Monday said it will acquire Essel Forex and Weizmann Forex for USD 57.35 million to cement its position in the financial services distribution.

Ebixcash World Money has entered into an agreement to acquire a controlling 74.84 per cent stake in India-based Weizmann Forex at an enterprise valuation of USD 65.94 million, an official statement said.

Weizmann Forex is the second largest inward remittance provider besides being one of the four largest foreign exchange and outward remittance providers in India, it said.

Ebixcash, a part of the Nasdaq-listed Ebix Inc, has also entered into an agreement to acquire 100 per cent assets of India-based Essel Forex for approximately USD 8 million, the statement said.

With the two acquisitions, Ebixcash stands as the largest distribution house in terms of network in financial services space covering more than 3,700 cities and more than 6,000 districts, the statement claimed.

It will also be the largest retail brand in terms of airport presence and will cover 95 per cent of airports in India in terms of retail presence, iy said.

The combined entity will have more than 80 percent share in the cash to cash inward money transfer business in India, will hold more than 50 per cent share in the student outward remittance and forex category, it said.It will be the largest non-banking player in the prepaid forex card segment with a total volume on the prepaid forex cards for Ebixcash World Money pegged at close to USD 1 billion.

Source: Money Control

Fresh from selling a 25 percent stake in its Italian operations, Corporacion America Airports SA said it may bid on new airport projects in Brazil and plans to start construction on a new runway in Florence and the construction of an extension to the terminal at Pisa airport will begin, doubling the current surface area. The financing of the works at the Florence and Pisa airports was already closed before the agreement was concluded

Fresh from selling a 25 percent stake in its Italian operations, Corporacion America Airports SA said it may bid on new airport projects in Brazil and plans to start construction on a new runway in Florence and the construction of an extension to the terminal at Pisa airport will begin, doubling the current surface area. The financing of the works at the Florence and Pisa airports was already closed before the agreement was concluded

Buenos Aires-based Corp. America sold a quarter of its stake in its Italian company to Investment Corp. of Dubai and formed an alliance to explore additional opportunities with the sovereign wealth fund on Wednesday. ICD paid EUR48.9 million ($56.9) for its stake.

The search for new airport investments will be focused on Italy, the Middle East and Eastern Europe, the companies said in a statement. There are no plans for ICD to participate in Latin America for now.

Source: Bloomberg