The Airports Corporation of Vietnam (ACV) on June 2 signed a contract with a joint venture comprising of firms from Japan, France and Vietnam (JFV) for consultancy services and the feasibility study for the first phase of Long Thanh International Airport project.

The Airports Corporation of Vietnam (ACV) on June 2 signed a contract with a joint venture comprising of firms from Japan, France and Vietnam (JFV) for consultancy services and the feasibility study for the first phase of Long Thanh International Airport project.

The feasibility study will be carried out from June 2018 to June 2019 and it will be assessed before submitted to the National Assembly for review in October 2019.

The ACV is preparing all required resources and taking necessary steps for the construction of the airport to be started at the end of 2020, he noted. “The airport will be completed and put into use in 2025 at the latest.”

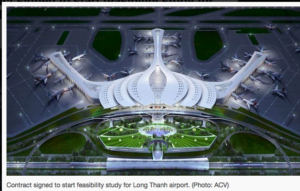

In March, the Ministry of Transport selected the lotus design developed by Heerim Architects and Planners from the Republic of Korea for the project.

The JFV joint venture gathers leading consulting and design firms with years of experiences in the airport construction industry, including Japan Airport Consultants (JAC) which provided design and construction supervision services for the expansion of Tan Son Nhat and Noi Bai International Airports, ADP Ingénierie from France, Nippon Koei and Oriental Consultants Global from Japan, and Airport Design and Construction Consultancy (ADCC) and Transport Engineering Design (TEDI) from Vietnam.

The Long Thanh International Airport has a total area of more than 5,580 hectares, spreading cross six communes in Long Thanh District, the southern province of Dong Nai. It is set to have a total investment of 336.63 trillion VND (14.8 billion USD), with construction divided into three phases.

In the first phase, a runway and one passenger terminal along with other supporting works will be built to serve 25 million passengers and 1.2 million tonnes of cargo each year. This phase is hoped to be finished by 2025.

In the second phase, one more runway and another passenger terminal will be constructed to serve 50 million passengers and 1.5 million tonnes of cargo a year.

After the third phase expansion, the airport will be able serve 100 million passengers and 5 million tonnes of cargo each year.

Source: Vietnam News Agency (VNA)

European airport trade association ACI EUROPE today releases its traffic report for April 2018, during which average passenger traffic in geographical Europe grew by +5% compared with the same month last year.

European airport trade association ACI EUROPE today releases its traffic report for April 2018, during which average passenger traffic in geographical Europe grew by +5% compared with the same month last year. Thunder Bay airport renovations heading toward completion

Thunder Bay airport renovations heading toward completion Semarang’s Ahmad Yani International airport inaugurated a new passenger terminal on 7 June.

Semarang’s Ahmad Yani International airport inaugurated a new passenger terminal on 7 June.