Temporary, semi-permanent and mobile airport terminals have become increasingly fashionable during the last decade; Examples include facilities catering for one-off events that deliver traffic peaks, or to handle a specific type of passenger – eg premium or budget;

Temporary, semi-permanent and mobile airport terminals have become increasingly fashionable during the last decade; Examples include facilities catering for one-off events that deliver traffic peaks, or to handle a specific type of passenger – eg premium or budget;

The latest project is in Poland where Warsaw’s new Modlin Airport will build a temporary terminal to meet growing demand, as it may soon be closed permanently.

The latest project is in Poland where Warsaw’s new Modlin Airport will build a temporary terminal to meet growing demand, as it may soon be closed permanently.

Airports large (Amsterdam Schiphol) and small (Magdeburg Cochstedt) are European examples of temporary terminal solutions.

The latest example may be seen in Poland. A representative of Warsaw Modlin Airport said recently that the airport plans to begin construction of a 2000sqm temporary terminal facility, representing investment of between PLN16 million (EUR3.7 million) and PLN18 million (EUR4.2 million). The structure will be durable enough “for up to 10 years of use”, and will comprise 500 sqm of commercial space. The terminal facility will handle non-Schengen and charter traffic, with capacity of three million passengers per annum.

‘Temporary’ is the name of the game for Modlin as it is expected to close when the new Central Polish Airport opens, supported by a budget facility at the existing Radom—Sadków airport, though, as highlighted previously by The Blue Swan Daily, that all remains some way in the future (2027). While Modlin’s closure is not certain it makes sense to take advantage of a non-permanent facility in a period of ‘uncertainty’.

The typical cost of the most basic 1000 sqm terminal may be as little as EUR1 million. There are numerous manufacturers of these facilities, few of which restrict themselves to the airport sector. By and large these companies are manufacturers of portable and semi-permanent structures across industries and moved into airports as demand became apparent.

Semi-permanent terminals are particularly appropriate to ‘low cost airports’, the conservative CAPA – Centre for Aviation definition of which is one where at least 35% of seat capacity is found on LCCs. It is often 95% or more, especially where a ULCC such as Ryanair or Wizz Air is the dominant carrier, pricing other airlines out and demanding sometimes costly marketing support from the airport’s municipal owners.

One such example was the privately-owned Magdeburg Cochstedt Airport in Saxony Anhelm, East Germany. Now closed, it attracted Ryanair to several routes a decade ago and commissioned a semi-permanent terminal in 2011. The airport’s owners contracted Neptunus to build a cost-effective, modern and functional extension to accommodate additional passengers and provide extra facilities.

A 900 sqm building was designed constructed and assembled within a few weeks, to a brief that specified “a terminal that was customer orientated, in respect of both our passengers and airline carriers, with a focus on low-cost travel yet still providing a comfortable and stress-free experience”.

Due to the modular nature of the structure, the terminal’s capacity could easily and quickly be expanded to cater for increased traffic levels in line with the airport’s growth and offered office accommodation to airlines as part of the structure.

Neptunus also built a temporary 3800 sqm departure hall for an airport at the other end of the size spectrum, Amsterdam Schiphol, in 2016/17. It was built to cater for two million ppa, has 20 check-in counters, five security lanes and public seating areas. Built for the opposite reason to the Modlin terminal, specifically to cater for strong growth in Schengen passengers, the structure is due to remain in place until the end of 2019. A temporary cargo space solution was also provided for Schiphol.

Source: The Blue Swan Daily. CAPA– Centre for Aviation

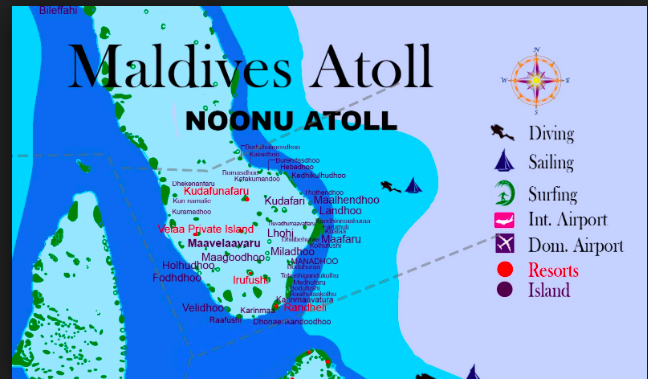

Incumbent president Abdulla Yameen Abdul Gayoom on Tuesday inaugurated the country’s new international airport in Noonu Atoll.

Incumbent president Abdulla Yameen Abdul Gayoom on Tuesday inaugurated the country’s new international airport in Noonu Atoll.

The latest project is in Poland where Warsaw’s new Modlin Airport will build a temporary terminal to meet growing demand, as it may soon be closed permanently.

The latest project is in Poland where Warsaw’s new Modlin Airport will build a temporary terminal to meet growing demand, as it may soon be closed permanently. Lithuania’s government estimates that around 700 million euros will be invested into the expansion of the airports in Vilnius, Kaunas and Palanga by 2028. The country plans to continue having a network of three international airports.

Lithuania’s government estimates that around 700 million euros will be invested into the expansion of the airports in Vilnius, Kaunas and Palanga by 2028. The country plans to continue having a network of three international airports.