The International Air Transport Association (IATA) revealed that present trends in air transport suggest passenger numbers could double to 8.2 billion in 2037.

The International Air Transport Association (IATA) revealed that present trends in air transport suggest passenger numbers could double to 8.2 billion in 2037.

The latest update to IATA’s 20-Year Air Passenger Forecast, shows that an increasing shift Eastwards in the center of gravity of the industry is behind the continued strong growth. Over the next two decades, the forecast anticipates a 3.5% compound annual growth rate (CAGR), leading to a doubling in passenger numbers from today’s levels.

The Association warned, however, that growth prospects for air transport, and the economic benefits driven by aviation, could be curtailed if protectionist measures are implemented by governments.

«Aviation is growing, and that is generating huge benefits for the world. A doubling of air passengers in the next 20 years could support 100 million jobs globally. There are two important things that stand out about this year’s forecast. Firstly, we are seeing a geographical reshuffling of world air traffic to the East. And secondly, we foresee a significant negative impact on the growth and benefits of aviation if tough and restrictive protectionist measures are implemented,» said Alexandre de Juniac, IATA’s Director General and CEO

Eastward shift in aviation’s center of gravity continues

The Asia-Pacific region will drive the biggest growth with more than half the total number of new passengers over the next 20 years coming from these markets. Growth in this market is being driven by a combination of continued robust economic growth, improvements in household incomes and favorable population and demographic profiles.

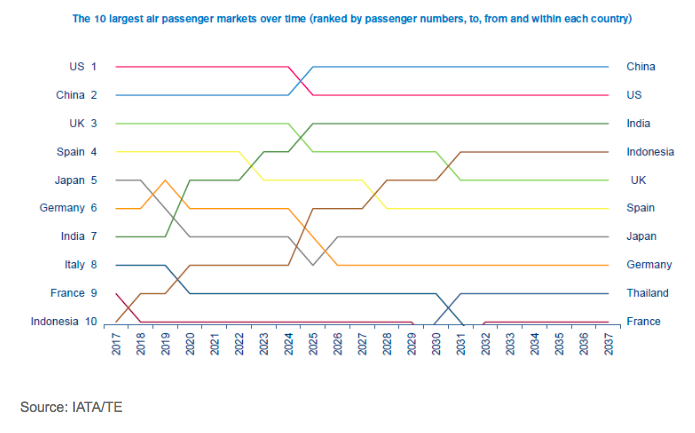

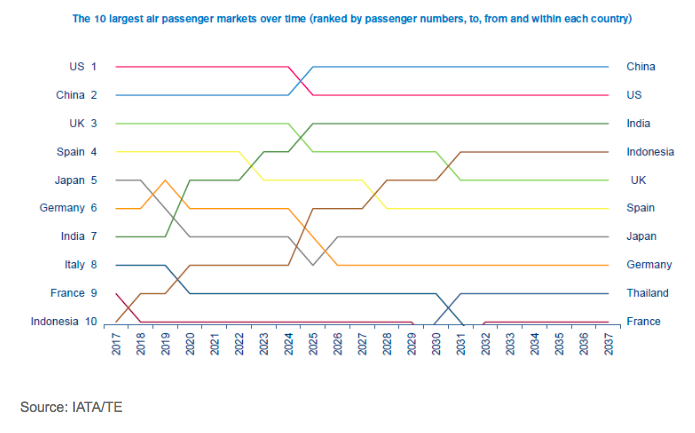

China will displace the United States as the world’s largest aviation market (defined as traffic to, from and within the country) in the mid-2020s. The rebalancing of China’s economy towards consumption will support strong passenger demand over the long term.

India will take 3rd place after the US, surpassing the UK around 2024.

Indonesia is forecast to be a standout performer—climbing from the world’s 10th largest aviation market in 2017 to the 4th largest by 2030.

Thailand is expected to enter the top 10 markets in 2030, replacing Italy which drops out of the ranking.

Globalization Reversed or Liberalization Increased?

The 3.5% CAGR to 2037 assumes an unchanged policy framework over that period. Policy shifts, however, are likely over time. Should protectionism continue to expand in a «reverse globalization» scenario, aviation would continue to grow, but at a slower pace and deliver fewer economic and social benefits. Under a liberalized environment connectivity would generate significantly more jobs and GDP growth.

Infrastructure and sustainability

No matter which growth scenario comes to pass, aviation faces an infrastructure crisis. Governments must work closely with the industry, to be more ambitious in developing efficient infrastructure, fit for purpose, and offering value for money.

«The world stands to benefit greatly from better connectivity. However, at this rate, airports and air traffic control will not be able to handle demand. Governments and infrastructure operators must strategically plan for the future. Decisions made now will have an impact on the value created by aviation for their regions,» said de Juniac.

The increased demand to fly creates a responsibility to expand in a sustainable manner. The aviation industry remains committed to its goals of carbon-neutral growth from 2020 onwards and cutting CO2 emissions to half 2005 levels by 2050. «Commercial aviation is one of the only global industries to take on such comprehensive environmental targets. With mandatory emissions reporting beginning on 1 January 2019 under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), this will help rally the industry to invest in more fuel efficient aircraft and sustainable aviation fuels,» said de Juniac.

Key facts

Fastest growing aviation markets in terms of annual additional O-D passengers from 2017 to 2037 (constant policies scenario):

China: 1 billion new passengers for a total of 1.6 billion

US: 481 million new passengers for a total of 1.3 billion

India: 414 million new passengers for a total of 572 million

Indonesia: 282 million new passengers for a total of 411 million

Thailand: 116 million new passengers for a total of 214 million

Regional growth (‘constant policies’ scenario) in 2037

Routes to, from and within Asia-Pacific will see an extra 2.35 billion annual passengers by 2037, for a total market size of 3.9 billion passengers. Its CAGR of 4.8% is the highest, followed by Africa and the Middle East.

The North American region will grow by a CAGR of 2.4% annually and in 2037 will carry a total of 1.4 billion passengers, an additional 527 million passengers.

Europe will grow at a CAGR of 2.0%, and will see an additional 611 million passengers. The total market will be 1.9 billion passengers.

Latin American markets will grow by a CAGR of 3.6%, serving a total of 731 million passengers, an additional 371 million passengers annually compared to today.

The Middle East will grow strongly with a CAGR of 4.4% and will see an extra 290 million passengers on routes to, from and within the region by 2037. The total market size will be 501 million passengers.

Africa will grow by a CAGR of 4.6%. By 2037 it will see an extra 199 million passengers for a total market of 334 million passengers.

Source: Travel Daily News.

Slovakia’s Ministry of Transport and Construction plans to finalise and submit a concession strategy to the Government for operation of Bratislava Ivanka Airport by late 2018. The Ministry argues the concession will “ensure further development of the airport” and accelerate passenger growth.

Slovakia’s Ministry of Transport and Construction plans to finalise and submit a concession strategy to the Government for operation of Bratislava Ivanka Airport by late 2018. The Ministry argues the concession will “ensure further development of the airport” and accelerate passenger growth.

The International Air Transport Association (IATA) revealed that present trends in air transport suggest passenger numbers could double to 8.2 billion in 2037.

The International Air Transport Association (IATA) revealed that present trends in air transport suggest passenger numbers could double to 8.2 billion in 2037.

Seven bidders have submitted offers, competing to build the Rs 4,200-crore greenfield Bhogapuram International Airport project in Andhra Pradesh.

Seven bidders have submitted offers, competing to build the Rs 4,200-crore greenfield Bhogapuram International Airport project in Andhra Pradesh. Sarajevo Airport has commenced the multi million euro expansion of its terminal building. Local company ANS Drive has been contracted to carry out the work valued at 15.3 million euros. The project includes the addition of 10.000 square metres of space to the existing terminal building, as well as the construction of an office/business facility at the airport, worth three million euros. The two projects are being financed from the airport’s own funds. «The expansion of the passenger terminal and the construction of a business facility are important strategic projects for Sarajevo Airport, which will provide capacity for further growth», General Manager, Armin Kajmaković, said. Upon completion, the terminal building will have the capacity to handle two million passengers. Currently, Sarajevo can welcome one million travellers per year, with the airport set to surpass that figure over the next two months. The project’s completion is scheduled for late 2019. Previously, the old terminal A building was demolished in order to make way for the expanded facility.

Sarajevo Airport has commenced the multi million euro expansion of its terminal building. Local company ANS Drive has been contracted to carry out the work valued at 15.3 million euros. The project includes the addition of 10.000 square metres of space to the existing terminal building, as well as the construction of an office/business facility at the airport, worth three million euros. The two projects are being financed from the airport’s own funds. «The expansion of the passenger terminal and the construction of a business facility are important strategic projects for Sarajevo Airport, which will provide capacity for further growth», General Manager, Armin Kajmaković, said. Upon completion, the terminal building will have the capacity to handle two million passengers. Currently, Sarajevo can welcome one million travellers per year, with the airport set to surpass that figure over the next two months. The project’s completion is scheduled for late 2019. Previously, the old terminal A building was demolished in order to make way for the expanded facility.