The government still intends to build two new family island airports by way of public private partnership, Tourism and Aviation Minister Dionisio D’Aguilar said Friday.

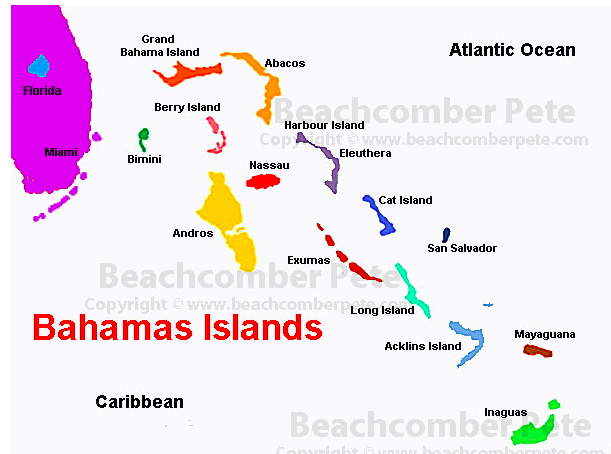

Exuma and North Eleuthera are to receive upgraded airports next, the minister said as he explained that those with the highest activity will be prioritised. He said Friday he wants to begin one new facility every six months.

More than eight months ago, Mr D’Aguilar told the House of Assembly of these plans. At the time he told members each project could cost around $35m. The high cost presents a compelling case for the use of PPPs in this instance.

The minister was asked Friday about the state of airports in the country and how officials intended to keep up with better tourist arrivals, which they said have been exceptional this year.

“So as you know there are 28 airports in the family islands. There is a lot of airports,” he said.“The amount of funds to upgrade them all to world class level is beyond our budget. So we are in a systematic way gonna do the busiest airports first.

“In 2011/2012 they did the Marsh Harbour airport. Based on a study that was done the next busiest one is Exuma. The one after that is North Eleuthera. So we are going to focus on those two next.

“Exuma I think we are very close to finishing the design of that. We’re very close to putting that out to bid. Obviously to build these airports will require funds and so the government is exploring public private partnerships.

Going to these private sector companies and saying look we would like to develop this airport are you prepared to partner with us in coming up with the funds and leading the construction?

“Because if you do one airport at a time it will take forever. So my vision is we gotta start Exuma and then six months later start North Eleuthera and that’s going to require a lot of funds in order to do that so we have to look to the private sector to see where they can assist in helping us to achieve our goal to deliver a much better airport product.

“In many instances tourism and tourism infrastructure has outgrown the airport and we need a bigger airport to accommodate the growth.

Source: Tribune 242

The Incheon International Airport Corp. (IIAC) will work together with Filipino multinational company San Miguel Corp. on developing the Philippines’ new airport near Manila.

The Incheon International Airport Corp. (IIAC) will work together with Filipino multinational company San Miguel Corp. on developing the Philippines’ new airport near Manila.